See how much you can earn

Initial Deposit: How much would you like to save?

Select Cryptocurrency

Additional Monthly Deposit ?

How long?

This calculator is for information and reference purposes only. Rewards are calculated per-second and may change from time to time depending on market conditions. The rates presented above are also not guaranteed for the duration of the above term.

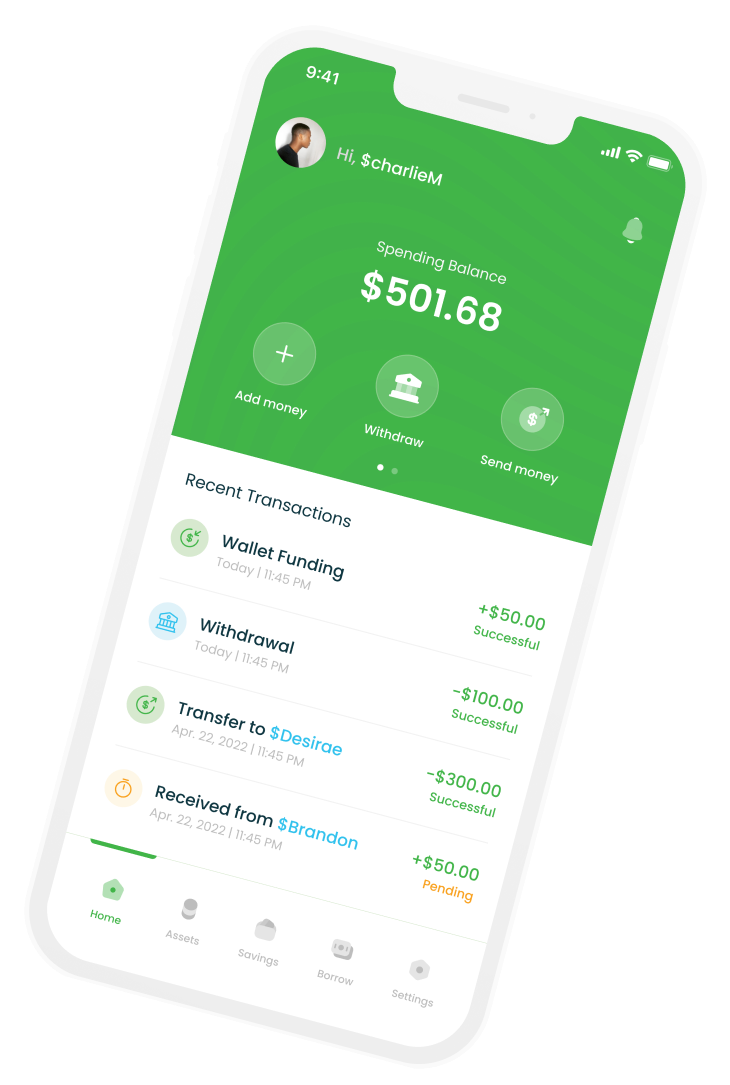

Take Control of your Crypto Portfolio

Lend, earn save and spend your crypto assets however you decide

Low Cost Loans

Meet emergency cash flow needs with instant low cost loans

Earn as you save

Earn daily interests of up to 8% on your savings

Free and instant

Every trasnfer is convenient with Quivertags. Free & Instantly

Borrow in your Best Interest.

40+ collateral options

Choose from over 40 cryptocurrency collateral options.

No credit checks

Your credit score is not required.

Lowest industry rates

Rates begin at 1% APR.

No Origination fee

With Quiver, you have the flexibility to use your funds as you please, anytime, anywhere.

Get early accessBacked by global partners and investors

We’re backed by top investors and VC who believe in us.